In a previous post on The Dividend Pig, I discussed opportunity in the Canadian mining sector.

As I discussed in that post, many investors overlook mining stocks as dividend growth companies, because of their lower dividend yields. Yet these are “dividend growth” companies many with strong balance sheets. They have recently raised their dividends, and have more potential for share price increase. Take Potash Corp. (POT) as an example which recently raised its dividend by a whopping 33%! In that post I specifically discussed Barrick Gold (ABX), Goldcorp (G), Potash Corp. (POT), and Teck Resources (TCK.B). As mentioned, Teck and Potash were at the top of my shopping list.

The Gold Selloff, Market Corrections, and Panic Selling

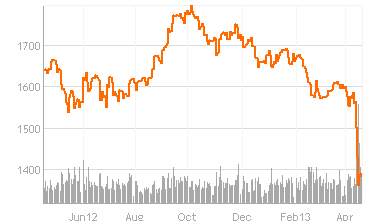

On Monday morning April 15th, I noticed the TSX Composite Index was down some -321 points (- 2.7%). Of course markets have had a good run-up since June 2012. Both the DOW and TSX advanced to their 2013 highs. Both markets were due for a correction at some point. On top of that, Gold had also been hitting its highs, just shy of $1,800 USD per troy ounce. Many gold-bugs wondered whether gold would even be able to reach the 2K mark before a major pullback.

The trigger was this Monday, April 15th, with the massive selloff of Gold Bullion. A troy ounce of gold closed on Monday at $1,361 USD, off -24% from its October 2012 highs (figure 1). This pulled down the gold producers significantly, with Barrick Gold (ABX) down -11.5% for the day, Goldcorp down -5.6% and Kinross Gold (K) down over -13.5% from its previous close. The panic selling also spread to the mining stocks with Teck Resources also down over -11.5% in the morning, closing down -7% for the day to $26.15 per share. The entire Materials sector of the TSX Composite was down -9.78%.

I was excited to see this panic selloff on Monday morning, and felt this was a great opportunity to add positions into the materials sector. My friend Dividend Mantra also saw opportunity this past Monday in the materials sector, and pulled the trigger on shares of Australian mining giant BHP Billiton. This is a sector I have been waiting to add to my portfolio for some time now, so I already had a list of stocks ready to go. I was able to scrape together 3.5K, enough to make a purchase in two companies. I purchased shares in Teck Resources (TCK.B) and Barrick Gold (ABX). Both these companies are also interlisted on the NYSE.

Teck Resources (TCK.B)

Teck resources (TCK) is Canada’s largest diversified resources company, with a market cap over 18.4 billion dollars. It is focused on the extraction and refinement of copper, steelmaking coal, and zinc. To a large degree Teck is influenced by China and the global economy, since much of its exports and sales are from steelmaking coal. A slowing global demand for steel, especially from China, has resulted in the lower share price for Teck.

[adsenseLeft]

On Monday, shares in Teck resources were pummelled with the selloff of gold producers and gold bullion. As Teck is not a gold producer, I felt the sudden decrease in share price Monday morning was due more from panic selling than company fundamentals. Since Teck was at the top of my shopping list, I bought 100 shares of Teck Resources (TCK.B) at a cost of $25.30 per share.

Back in January 2011, Teck Resources (TCK) was trading over $61 per share. Teck Resources is now trading at its two year lows. Teck currently has a profit margin of 7.84% and a debt to equity ratio of 40.02. The profit margin is lower than I normally prefer for a company, but that is also reflective of the slowing demand for raw materials. Teck currently pays a dividend yield of 3.604%, with a dividend payout ratio of 64.7%. One feature I like about mining stocks, Teck included, is many pay out their dividends semi-annually instead of quarterly. This will give me a larger dividend for a smaller purchase, and allow me to DRIP my shares. Teck is also a “dividend growth” company, and raised its dividend in November 2012 by 12.5%.

Barrick Gold (ABX)

Gold producers including Barrick and Goldcorp comprise a significant percentage of the TSX composite index. They are held in many Canadian mutual funds as a significant holding. Barrick and Goldcorp are not junior mining companies. They are in fact, the world’s largest gold mining and gold producers. Whether you personally view gold as a tangible asset or not, is a moot point. Gold’s scarcity has made it a sought after commodity for thousands of years, and in our modern society gold is considered a hedge against global currency risk. Most countries continue to stockpile gold for exactly this reason.

Back in July 2012, I compared the two major gold producers in Barrick Gold vs. Goldcorp. I also compared the two companies in April 2012 in Are Gold Stocks Cheap? Since then I’ve been waiting for an entry point into the gold producers. Goldcorp is clearly the much better company in terms of fundamentals, and is also a better choice with its much lower debt levels. In fact Goldcorp has very little debt with a debt to equity ratio of only 3.42% and a solid profit margin of 32%. I clearly prefer Goldcorp’s fundamentals over Barrick. Unfortunately Goldcorp also has a much lower dividend yield, currently at 2.13%, compared to Barrick’s yield of 4.49%.

Barrick Gold has had significant management and profitability issues over the last couple of years. In a recent Globe and Mail post, has Barrick Bottomed?, Lou Schizas looked at the problems plaguing the company. In 2011 Barrick Gold paid $7.3-billion to acquire Equinox Minerals. With retreating Copper prices, and poor drilling results at the Lumwana Mine, the acquisition turned out to be a dud. This caused Barrick to write down over $3.8 billion dollars off its books. Long time Barrick CEO Aaron Regent was promptly ousted. The decline in Barrick on Monday was as much an issue over recent management and the Equinox acquisition, as it was about the decline in gold bullion. That also makes Barrick much more of a potential value play. I purchased a small position of 50 shares in Barrick Gold (ABX), at a price of $20.13.

Reader’s what’s your take? Interested in the Canadian mining sector? Have you pulled the trigger on any mining stocks or gold producers?

Disclaimer: I am long on ABX and TCK.B.

I did an analysis on CLF – Cliffs Natural resources and while reviewing iron ore, saw that all resources are down significantly and by similar magnitudes.

http://seekingalpha.com/article/1345831-4-reasons-cliffs-natural-resources-could-be-bottoming

The general consensus is that gold sell off was over done, but this is a normal reaction after any major sell off. The long term trends are troubling for gold, and the US is slowing down for Q1/Q2 due to sequester. This will hurt China which hurts all the companies you mentioned. The nice dividend for all companies mentioned should soften the blow, should the stocks be at a bottom at this time.

CrispyCrunch I think your comment is bang on and I agree with your points.

Thing is, when people are afraid of sectors and stocks, and they hit ultra-lows on panic selling, it says the bottom is near. I don’t think we are near the bottom yet, especially for a company like Barrick. But there is enough fear to indicate the bottom is close enough. I didn’t mind investing a small amount in Barrick, and waiting to see what unfolds next. My only concern is I may have bought a little early… 😉

Cheers

CLF is way oversold. Gold is not there yet. It has so more down days ahead.

Jai, nice to see you over here! 🙂

I believe your right, gold may indeed have many down days ahead. If gold producers decline further I will be adding to Barrick and buying a core position in Goldcorp. I felt Monday was one entry point, of a few more to follow.

PS

Congrats on the new site. I will contact you later about that.

Cheers!

This is typical market irrationalization, everyone is running for the exits and trampling over anything that gets in the way such as ABX the top dog in that sector. I picked up some shares recently but will be backing up the truck once the carnage is over.

Hey Marvin, thanx for posting. 😉

Your’e right, everyone runs for the door. Regardless of all its troubles, Barrick is a big company! Just wait, and five years down the road Barrick will be trading for $50 per share.

Just remember that Barrick was also hit for reasons beyond a crashing gold bullion price. Have a look at Goldcorp as another choice among the gold producers, it’s “rock solid”. I really had a tough decision buying Barrick when Goldcorp was the better choice. Regardless, I think there will be more opportunity to buy into this sector!

Cheers!

Ninja,

Thanks for the mention!

I guess we both noticed the drop in commodities at the same time. This is one of those times when you figure out exactly what kind of investor you are. Do you enter the fire or not? Become greedy when others are fearful, or do you become fearful as well? The S&P 500 is up 8% YTD and my recent purchase BBL is down 23% YTD. That’s a 30% spread I can get on board with.

Best wishes!

Mantra, your choice of BHP Billition was excellent! well done… 😉

I am very pleased with my purchase of Teck Resources, I really think the spill-off from the gold bullion selloff was unwarranted in the mining sector. I saw a friend buy Teck Resources for $10 sell at $30, and then saw it hit nearly $70 per share a couple of years back. The mining stocks have tremendous potential for capital growth, and are so discounted in price right now.

Barrick is going to be a rough ride, and there may be more down days ahead. In the long run, it will do just fine, and surprise many when it bounces back. These are the opportunities that come with some risk, eh?

Keep up the good work Mantra! 🙂

Cheers

I’m buying ABX and BNS

Irrational behavior of the shorters, day traders and the institutional “investors” is always good for us. I triggered on the bullion itself, since it’s a part of my portofolio diversification and wealth preservation against the mass money printing abd devaluation. It cut my average cost in some order of magnitude.

For the stocks I triggered on undervalued good oil companies that the shorters battered recently.

As for these miners I’m not personnally interested by it for now, they are far on my valuation monitor.

Like in 2012, these dips are always good to make money 🙂

Ninja, I also took this as a great opportunity to add more gold to my portfolio. Now, few days later it seems to be working well. If however the gold goes even lower, I will be adding more.

Martin, GoldCorp (G.TSX) is next on my list. 😉

I wish you the best of luck with Barrick but I never trusted gold or gold producer… Recent drop in the price of gold made me even more cautious.

Barrick profit didn’t follow gold price when it was skyrocketing… too much speculation on the price of the bullion.

It’s interesting to find another Dividend Investor to buy some stake in gold miners! I bought ABX as well back October and regret not loading up on more than I did. I bought 141 shares @ $7.08/share. I also bought GDX that month as well as SIL, NEM, and GG. I sold off my NEM and SIL in early January (too early before the rally because I needed the cash) but kept my ABX and GDX positions. I’ve actually added more ABX as the shares kept creeping up.

Both my ABX and GDX are up a total of $5000 right now (total $10,000) and I’m contemplating on shaving off half and use the profits to buy more dividend stocks or add to my current positions. I think I will stay on this bull run and perhaps even make ABX and GDX my permanent positions as they do pay dividends. Thanks for sharing your article, it has helped me realize that gold miners could be useful and treated the same in a portfolio for dividend growth!

Yes exactly – thanks! 🙂

I got a lot of flack on the Dividend Pig for that post. But you know, when you value invest and buy at the bottom – it takes fortitude to do it. In the end regardless of what you think about gold, it’s intrinsic value or not, it still remains a valuable commodity and always will.

Cheers

Avrom