Written by Ben Carlson

When bull markets are in full swing, investors become enamored with hot growth stocks. This explains why names like Tesla (TSLA), Facebook (FB) and Netflix (NFLX) have garnered the attention of market participants with their fast-paced growth prospects and volatile stock price movements.

It’s simply much easier to become more optimistic about future growth in technology companies when stocks are going up. People are making money hand over fist and everyone’s happy. This is why stocks with “can’t miss” narratives do so well in times like these.

Growth stocks become the sexy investments because they are a bet on an unknown future. In bull markets optimism grows and can lift stocks with greater uncertainty built into their share price and future earnings numbers.

Because of this dynamic, boring value stocks that pay dividends and generate consistent cash flow can eventually become overlooked. It’s no fun investing in a stock based on its historical or present situation when you can make a gamble on the future with a high-flying growth stock.

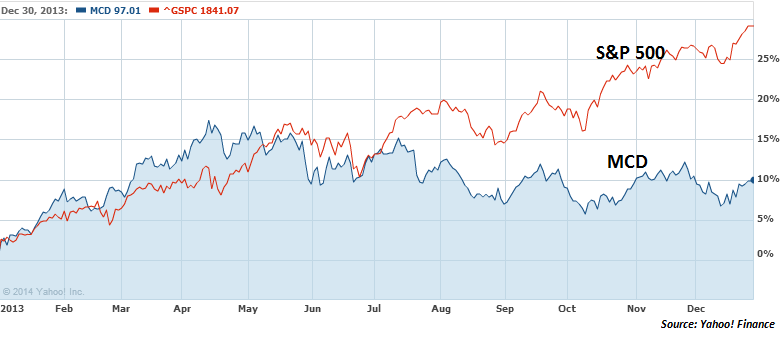

One of these overlooked dividend stocks in the current bull market has been McDonald’s (MCD). Although 2013 was an outstanding year for the U.S. market as a whole, McDonald’s was a notable laggard. Here is a price graph with the 2013 performance for MCD and the S&P 500:

While the market rose in excess of 30% McDonald’s was up “only” 10%. Not a bad year, but not great on a relative basis. In fact, since March of 2009, while the S&P is up more than 160%, McDonald’s is up a little more than half of that, returning around 85%.

This is a company with a built-in moat because of the recognizable global brand name.

McDonald’s has increased their dividend payment every year since the mid-1970’s. The yield currently stands at roughly 3.3%, still above the rapidly rising U.S. Treasury bond yield.

Earnings are up over 350% in the past decade while the share count is down over 10% since 2008 as the company has continued to buy back their own shares in the open market.

The average return on invested capital (how well a company generates cash flow relative to the invested capital in the business) over the previous 5 years is well over 30% a year.

Those are the pros, but it makes sense to look at the cons of any investment candidate to see both sides.

Many dividend paying stocks have performed wonderfully in this bull market, so McDonald’s is not a company without faults at the moment. Brand name companies with solid yields don’t trail the market because everything is going great.

Sales have become stagnant in the past few years with increased competition from fast casual food companies such as Chipotle (CMG) and Panera Bread (PNRA).

The company has also taken a bit of a PR hit because of the low wages they pay most of their customer service employees. This could continue to be a contentious issue going forward.

At this point, investors need to ask themselves whether or not these issues are priced into the current level of the stock.

I think there’s a high probability that these problems have been priced in.

Analyst opinions on the stock are lukewarm, at best. According to Yahoo! Finance, there are currently 15 holds and only 12 buys on the stock (analysts rarely issue sell recommendations on stocks, so a hold is the closest thing to a sell recommendation you will see from this group).

McDonald’s is also an innovative company that has worked through issues in the past. They were one of the first fast food companies to institute a coffee shop atmosphere by sprucing up the appearance of their restaurants for dine in patrons. The McCafe model has been a bright spot for the company since its introduction in 2009.

Most other fast food restaurants have slowly adopted the same model.

If the market continues to charge higher it’s quite likely that McDonald’s will remain a relative underperformer. However that may change as the bull market matures and investors look to rotate to find undiscovered value in a richer market.

But if things get dicey and investors begin to look for safe haven stocks with juicy dividend yields then McDonald’s should fit the bill.

Either way, you get paid to wait by clipping 3.3% a year in dividends.

Ben Carlson manages institutional investments and is the author of the blog A Wealth of Common Sense. Follow him on Twitter @awealthofcs.

Thanks for the great article Ben. McDonalds has been a great company for investors historically. I agree that the current valuation is less inflated than the general market……but I believe it is still overvalued given their enormous size and decelerating sales. McDonalds has shown an inability to innovate in recent years. It’s dividend, which is good, is not likely to grow tremendously given the 56% payout ratio. I could be all wrong here, and if sales in Europe explode I will look like a fool, but my thinking is that you’re paying a lot for a slow growth behemoth at todays prices. Again, thanks for the article

-Bryan

Good points. Surprisingly the sales have actually been growing faster in Europe the last couple of years than they have in the US. The real growth continues to be in emerging markets.

You’re right that a pick-up in economic activity is probably warranted to see decent performance (which I think is a good possibility for 2014), but it’s still a company with a fortress balance sheet, solid margins and high returns on equity, asset and capital (which means the dividend stream is safe and should continue to rise).

I do think the best thing about this stock is the fact that most investors have similar thoughts that the growth is over. I think it’s priced in, but like you said, we’ll see how the economic situation unfolds.

Fast Weekly, I think you made some good points!

Actually McDonald’s is quite innovative, McCafe being one of them, as well as their expansion into other markets. but its Asia and emerging markets where MCD will see the most growth in 2014.

I don’t think I ever invest in a company like McDonald’s, with the expectations of exceptional performance. It is exactly because it is a behemoth, I choose to invest in it – I don’t lose sleep over it. Slow and steady wins the day! 🙂

With a PE Ratio of only 17.4 I don’t think McDonald’s is overvalued, still room for this one to grow a little. But I do agree with you, I wouldn’t be running out to buy more shares at this price – just sit back and let the dividends roll in.

Cheers!

MCD is on my ‘buy-and-forget’ list! It’s daily fluctuations hardly bother me! I know many think MCD is overpriced, but I still consider it a good bet in the long run.

I guess that would be my line of thinking as well. It’s never going to be a home run stock, but you can get great diversification benefits from MCD over the various market cycles. Case in point was 2008 where the S&P was down nearly 40% while MCD was up 8% or so. Not saying it will happen again, but I still think this is a solid, brand name company.

As you said to me in a previous post MoneyCone, “I can sleep at night holding this one.”

As Ben points out, you don’t buy a stock like MCD for the home run. You buy it for the steady dividends, and steady growth.

Also, MCD is called a defensive stock for a reason. 😉

Cheers

Great summary DN.

Perhaps it was yourself that mentioned at one time the interesting real estate aspect of MCD. Since they own many of their stores they thusly also own the buildings and property. Diversification through geography as well as a nice REIT if they ever move in that direction.

Wouldn’t that be a nice investment. 😉

Wall Street speculates about MCD spinning off the property as a REIT every time growth slows. It’s not going to happen, and as an investor you don’t want it to happen. What you do want is some new, creative and healthy menu items. The menu is going through another lull, with the last big innovation (McCafe) nearly a decade behind us. Regarding employee pay and benefits, MCD has a history of encouraging employee ownership through stock ownership, but I think that has faded in the past 10-20 years. I would love to see something done to rebuild that sense of employee ownership.

Hi Jason,

I doubt that MCD would ever offer a REIT for their properties. But assuming they did, why do you think it would be such a bad idea?

I’d be very interested in that opportunity actually. 😉

Cheers

McDonalds is a great and wonderful company!

I think I´ll purchase shares next week.

In a poll on my blog people vote with 56% for a purchase of MCD 🙂

I trust them… and will buy MCD next week…

regards!

D-S

D-S,

I also think McDonald’s is a great and wonderful company too! And I’m happy to collect the dividends. 😉

I’m also happy to be holding MCD, but I’m not sure I’d be rushing to the door to buy shares now. While not overpriced it certainly isn’t cheap either. You would be paying fair market value (See Fast Weekly comment above).

Be patient and maybe you can buy MCD for a lower price in 2014.

See this earlier post from December 2011:

http://www.dividendninja.com/is-mcdonalds-overpriced-1/

Cheers

It’s not so much that the idea itself is a bad one, but rather that I don’t see why it’s a good idea. My concern is Wall Street talks about the REIT spinoff when they don’t see any growth coming from the restaurants, so it strikes me as a financial maneuver for the sake of one-time gains, while leaving the restaurants with the same underlying issues. What investors want is a growing company — when management delivers growth, the Street forgets about spinning off a REIT.

My one caveat would be if managing the real estate portfolio was proving too cumbersome to be under the same management as the restaurants. In that case, there would be long-term benefits to the company.

One of my very strict resolutions for 2014 is to stick with buying only “buy and forget” types of companies. In the past I’ve chased a few things with mixed results. As I turn my focus almost entirely to earning income via dividends and solid companies that grow over time, I’m sticking to companies similar to MCD for the future.

A MCD REIT does sound interesting…

Good discussion on the merits of MCD as an investment here.

I don’t put much faith in Wall St. analyst recommendations, but it’s funny to note that they can’t make their mind up on this stock either. Yesterday Wells Fargo downgraded the stock from buy to hold while this morning Morgan Stanley upgraded it to a buy.

I have been looking to score Mcdonalds for quite some time now. I have utilized options to capitalize on Mcdonalds potential but have yet to buy it flat out.

McDonald’s is one of my core holdings in my dividend growth portfolio. I think MCD still has plenty of room to expand internationally and even with lower growth, they can still return tons of value to shareholders through share repurchases and dividends. Cash is king and MCD is a cash generating monster that I’m happy to own.

Dan, couldn’t have said it better!

MCD is also a core holding in my portfolio as well.

Cheers

Hi Dividend Ninja,

Thanks for the information. I really have my eyes set on MCD and I really think that they will increase revenue by a big margin in the future due to the McRobots!

I was also wondering if you could add me to your blog roll? I’m going around asking everyone that I’ve added to my blog roll to add my site to theirs. I would appreciate it if you could!

I’ve also developed a small windows application that helps me keep track of the cost basis and dividends paid. I use it as a tool for myself but I thought maybe it could help others.

If anyone else that reads this would like to give it a try, I would much appreciate it!

The way the application works is that it connects through Yahoo Finance and retrieves all live data and calculates them accordingly and presents it to you in one view! It can also generate a spread sheet in excel as well. I hope that you could check it out sometime, it is 100% free to download! It can be found @ https://dividendliberty.com/dividend-application-windows-7810/

Thanks again and keep up the good work!